credit card length of time

The length of time since your newest account was opened and the average age of all your accounts are also factored into the length of credit history. FICO continues to factor in closed credit accounts when calculating the length of your credit history until they fall off your credit report which usually takes 7 to 10 years.

Credit Card Grace Periods Explained Chase Amex Citi More

Once you submit the dispute whether by mail or phone the credit card issuer will contact the merchant for their side of the story.

. Capital One as an example. In a FICO Score High Achievers study people with a FICO Score ranging from 800-850 had an average. Finally adopt a mindset where you see the length of your credit history as part of your greater long-term credit strategy.

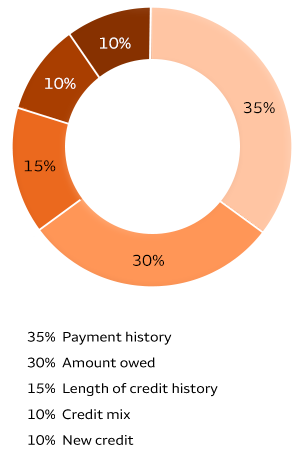

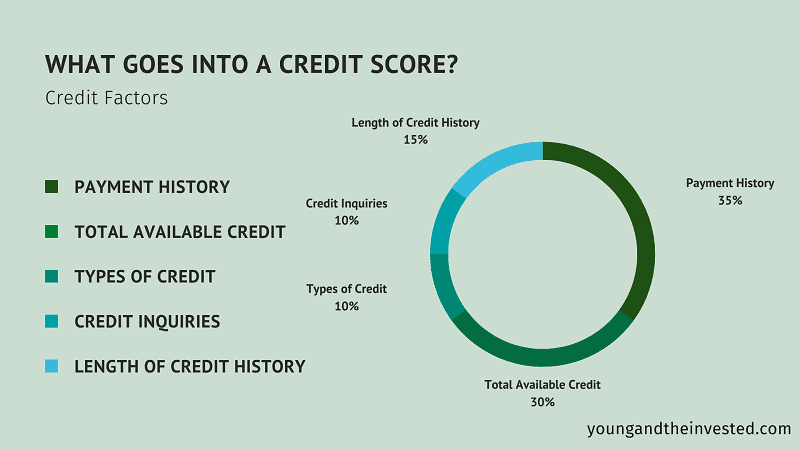

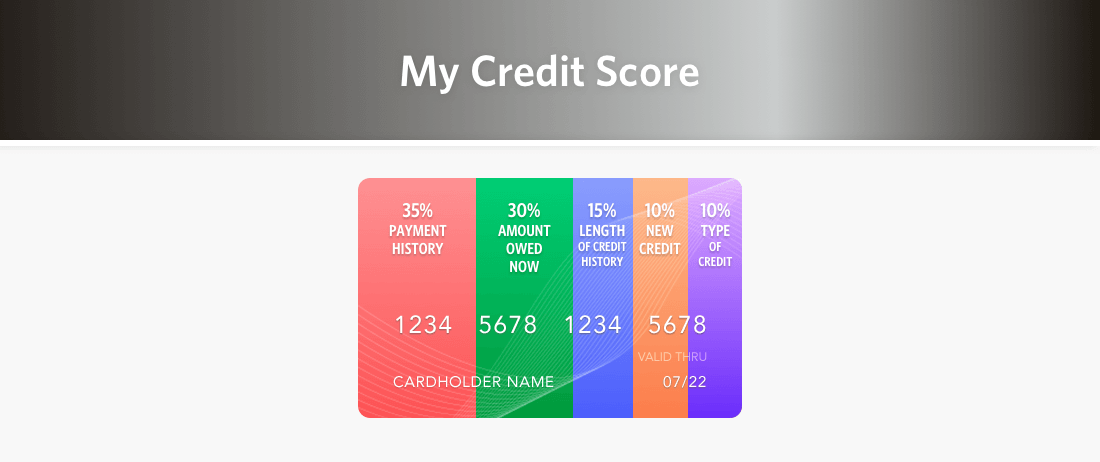

The length of your credit history or how long youve been using credit typically accounts for 15 percent of your total credit score. Use your card but keep the balances low and pay on time. But I wouldnt be too concerned about even up to a couple weeks especially if.

Your secured card deposit also acts as your collateral and credit limit. So pretty fast in my experience. What Is Considered a Good Length of Credit History.

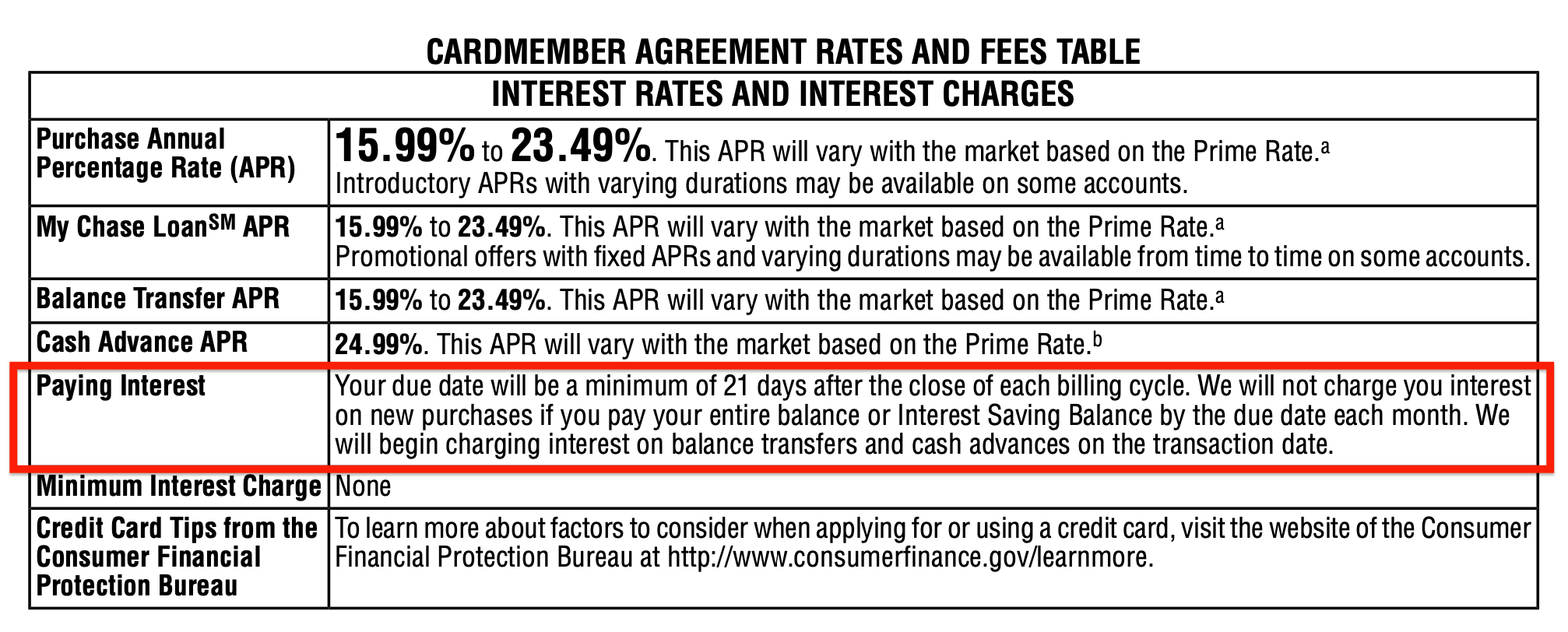

Credit card billing cycles vary and usually range from 28 to 31 days depending on the credit card and the issuer. For example if you have a credit card and it has a 28-day billing. Seven years is a good length of credit history especially considering closed and negative items tend to fall off your report by.

The deadline for scheduling or mailing your payment will depend on your due date and the time it takes your credit card company to receive and process payments. Credit score calculations use both the average age of your accounts and the age of your oldest. Interest free period on credit cards can go up to as high as 45-51 days depending on the time when you swipe your card.

For the oldest account six years is only moderate--some people will. The length of time for a balance transfer varies by the financial institution issuing the card for cards that operate on the Visa or Mastercard networks. While it isnt the most important factor used.

When I did a BT to my Discover card it took about four days. During the time of the dispute you are not.

How Long Does It Take To Get A Credit Card Bankrate

What You Should Know About Inactive Credit Card Accounts Equifax

Can You Raise Your Credit Score By 100 Points In 30 Days

How Length Of Credit History Affects Your Credit Score Nerdwallet

How To Use A Credit Card Best Practices Explained Valuepenguin

How Long After Opening Your First Credit Card Will Your Score Be Created Nextadvisor With Time

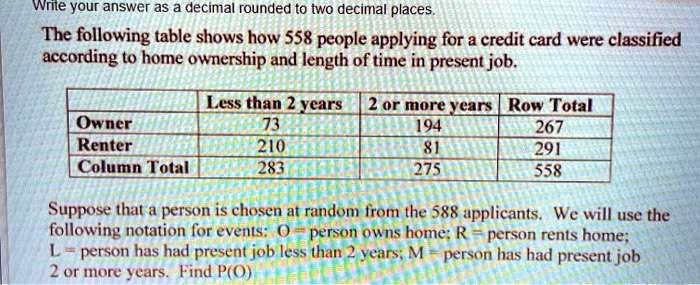

Solved Wrile Your Answer As Decimal Rounded T0 Two Decimal Places The Following Table Shows How 558 People Applying For Credit Card Were Classified According To Home Ownership And Length Of Time

6 Best Credit Cards Of October 2022 Money

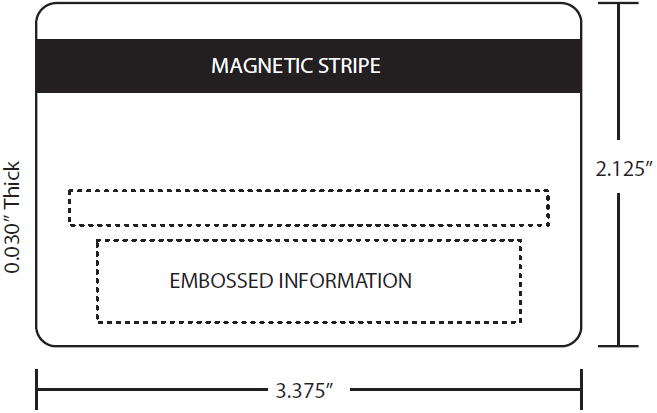

Magnetic Developer Magnetic Encoding Magnetic Stripe Enconding Magstripes Coercivity Hico Loco Jitter

Re Spawn Time In Credit Cards And End

Chime Credit Builder A New Way To Build Credit

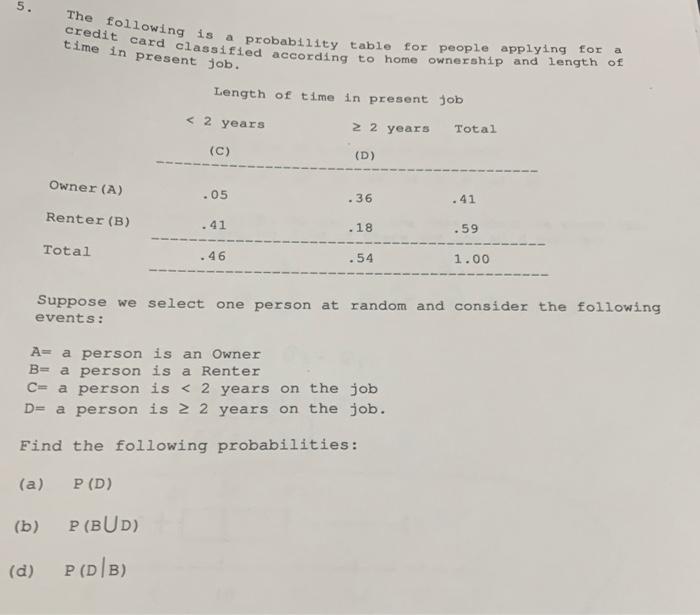

Solved 5 Credit Card Classified According To Home Ownership Chegg Com

Best 0 Intro Apr Credit Cards For October 2022

How Long Should You Keep Credit Cards Open Creditrepair Com

How To Get 100 Approved For Credit Card 5 Best Offers For Any Credit